The Reserve Bank of India’s new real-time cheque clearance system, aimed at improving ef ciency, is facing glitches, with some customers complaining about delays.

ET takes a look back at how cheques have evolved over the years amid a steep rise in digital payments:

What is the current cheque clearance system?

Banks followed fixed batch-based processing. Clearance took 1-2 business days.

How has the cheque clearance system evolved?

Pre-1980s: Manual, took a week 1980s: Time cut to 1-3 days with MICR sorting

2008: One day, after the introduction of the cheque truncation system (CTS)

2021: Nationwide grid introduced uniform T+1 clearing

2025: A few hours, as banks clear continuously

What has changed?

Banks are processing cheques throughout the day, allowing funds to be credited within a few hours of presenting cheques.

When was the new system implemented?

In phases, with the first batch starting on October 6, 2025, until January 2, 2026. The second phase, starting January 3, 2026, will speed up the process further.

Who uses cheques?

Joint-partnership firms, old family-run MSME units, trusts, co-operative societies, educational institutions, and some government departments. Cancelled cheques are used for setting up auto-debit mandates.

What about companies and individuals?

Companies have moved to net banking facilities like NEFT and RTGS, while individuals are using UPI.

What does the data tell?

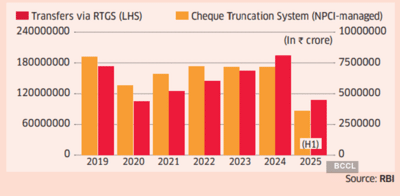

Usage of cheques has plunged since the Covid pandemic. The growth in the value of cheques processed by banks fell 10% between 2019 and 2024. In the same period, the value of funds transferred via RTGS increased 12%. Meanwhile, the number of UPI transactions crossed 20 billion in August, reaching nearly Rs 25 lakh crore, underscoring its high usage for retail payments.

ET takes a look back at how cheques have evolved over the years amid a steep rise in digital payments:

What is the current cheque clearance system?

Banks followed fixed batch-based processing. Clearance took 1-2 business days.

How has the cheque clearance system evolved?

Pre-1980s: Manual, took a week 1980s: Time cut to 1-3 days with MICR sorting

2008: One day, after the introduction of the cheque truncation system (CTS)

2021: Nationwide grid introduced uniform T+1 clearing

2025: A few hours, as banks clear continuously

What has changed?

Banks are processing cheques throughout the day, allowing funds to be credited within a few hours of presenting cheques.

When was the new system implemented?

In phases, with the first batch starting on October 6, 2025, until January 2, 2026. The second phase, starting January 3, 2026, will speed up the process further.

Who uses cheques?

Joint-partnership firms, old family-run MSME units, trusts, co-operative societies, educational institutions, and some government departments. Cancelled cheques are used for setting up auto-debit mandates.

What about companies and individuals?

Companies have moved to net banking facilities like NEFT and RTGS, while individuals are using UPI.

What does the data tell?

Usage of cheques has plunged since the Covid pandemic. The growth in the value of cheques processed by banks fell 10% between 2019 and 2024. In the same period, the value of funds transferred via RTGS increased 12%. Meanwhile, the number of UPI transactions crossed 20 billion in August, reaching nearly Rs 25 lakh crore, underscoring its high usage for retail payments.

You may also like

UAE: Dubai Ruler Sheikh Mohammed's book 'Lessons from Life' now released in English following massive popularity

Nivin Pauly plays Attendent Sanal Mathew in Arun Varma's upcoming thriller 'Baby Girl'

'I wish I'd never signed for Liverpool - I never had connection like I did at Chelsea'

Car loan 'rip-off' victims to get £700 compensation - how to claim

Rioting, obstructing public servant case against Cong MP Shafi Parambil